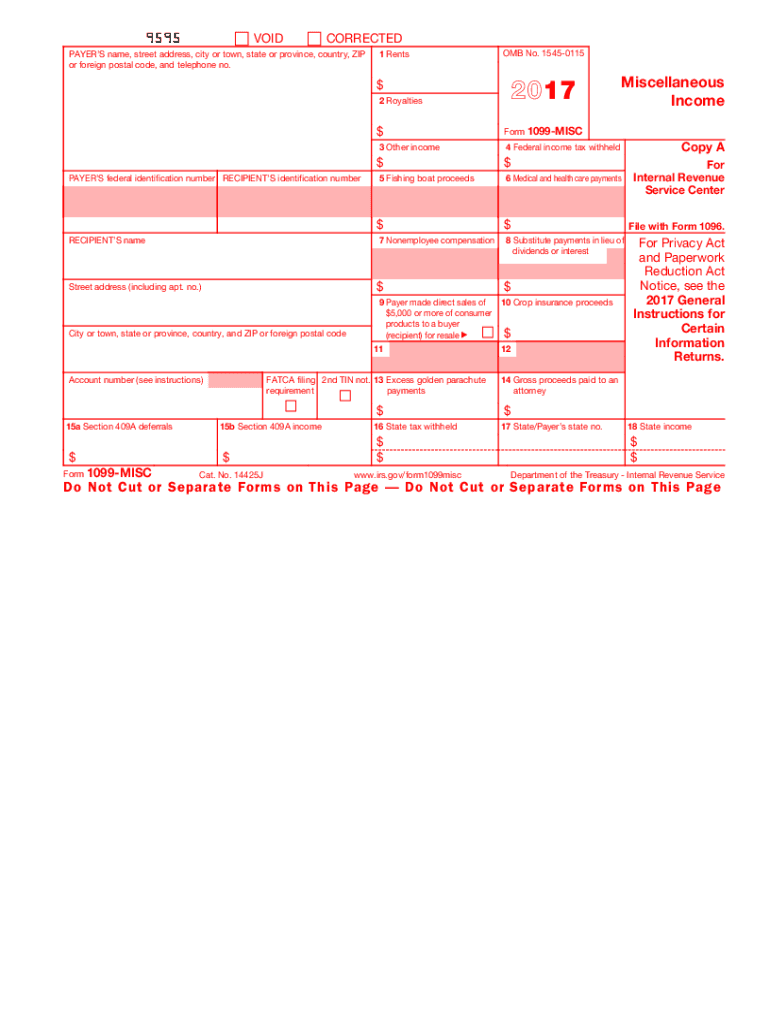

Form 1099 MISC 2017

What is the Form 1099 MISC

The Form 1099 MISC is a tax document used in the United States to report various types of income that are not classified as wages, salaries, or tips. This form is typically issued by businesses to report payments made to independent contractors, freelancers, and other non-employees for services rendered. It is essential for both the payer and the recipient, as it helps ensure accurate reporting of income to the Internal Revenue Service (IRS).

How to use the Form 1099 MISC

To use the Form 1099 MISC, businesses must accurately fill out the form with the required information, including the recipient's name, address, and taxpayer identification number (TIN). The total amount paid during the tax year must also be reported. This form should be provided to the recipient by January thirty-first of the following year, and a copy must be submitted to the IRS by the end of February if filing by paper, or by the end of March if filing electronically.

Steps to complete the Form 1099 MISC

Completing the Form 1099 MISC involves several key steps:

- Gather all necessary information about the recipient, including their name, address, and TIN.

- Determine the total amount paid to the recipient for services rendered during the tax year.

- Fill out the form, ensuring that all required fields are completed accurately.

- Review the form for any errors before submitting it to the recipient and the IRS.

Key elements of the Form 1099 MISC

The Form 1099 MISC includes several key elements that must be filled out correctly. These elements include:

- Payer Information: The name, address, and TIN of the business or individual making the payment.

- Recipient Information: The name, address, and TIN of the person or entity receiving the payment.

- Payment Amount: The total amount paid to the recipient, categorized by type of payment, such as non-employee compensation or rents.

Filing Deadlines / Important Dates

It is crucial to adhere to the filing deadlines for the Form 1099 MISC to avoid penalties. The following dates are important:

- January thirty-first: Deadline to provide the form to the recipient.

- February twenty-eighth: Deadline to file the form with the IRS by paper.

- March thirty-first: Deadline to file the form electronically with the IRS.

Penalties for Non-Compliance

Failure to file the Form 1099 MISC on time or providing incorrect information can result in penalties imposed by the IRS. The penalties vary based on the lateness of the filing and the size of the business. It is advisable to ensure compliance to avoid unnecessary financial repercussions.

Quick guide on how to complete 1099 misc 2017 form

Discover the simplest method to complete and sign your Form 1099 MISC

Are you still spending time preparing your official paperwork on physical copies instead of handling it online? airSlate SignNow offers a superior method to fill out and sign your Form 1099 MISC and associated forms for public services. Our intelligent eSignature solution equips you with everything necessary to manage documents swiftly and in line with official standards - comprehensive PDF editing, organizing, securing, signing, and sharing tools all available within an easy-to-use interface.

Just a few steps are required to fill out and sign your Form 1099 MISC:

- Insert the fillable template into the editor using the Get Form button.

- Verify what information you must supply in your Form 1099 MISC.

- Move between the fields using the Next button to ensure you don’t miss anything.

- Utilize Text, Check, and Cross functions to fill in the gaps with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Conceal fields that are no longer relevant.

- Click on Sign to create a legally valid eSignature using any method you prefer.

- Add the Date alongside your signature and finalize your task with the Done button.

Store your completed Form 1099 MISC in the Documents section of your profile, download it, or export it to your preferred cloud storage. Our service also provides flexible form sharing options. There’s no need to print your templates when you can send them to the relevant public office - use email, fax, or request a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 1099 misc 2017 form

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Did you fill out the form "1099 misc"? If so, for what purpose? Within the context of work, is it like a contract?

One of the most common reasons you’d receive tax form 1099-MISC is if you are self-employed or did work as an independent contractor during the previous year. The IRS refers to this as “non-employee compensation.”In most circumstances, your clients are required to issue Form 1099-MISC when they pay you $600 or more in any year.As a self employed person you are required to report your self employment income if the amount you receive from all sources totals $400 or more. In this situation, the process of filing your taxes is a little different than a taxpayer who only receives regular employment income reported on a W-2.

-

How much does it cost to outsource the printing and filing of 5000 1099 Misc forms?

Most of the larger places in the US will cost you around $4-6 per employee. 5000 is a lot, so I'm sure you'll find someone who will negotiate. So to do it "right" and full-service from a named payroll company, I'm guessing $20,000.Now retail, maybe $2-3 of that is for e-filing services and $2-3 is for printing/mailing. So if employees are printing their own, getting emails, or getting links to a secure FTP site, then maybe you can save half of that by not mailing. Check the rules, but that's pretty common. For the other half, I'd bet plenty of companies have really good deals, including the IRS--I'd bet money they allow you upload a 5,000 line CSV for free or next to it.Of course there's India and stuff--real outsourcing--but I'd have to quintuple check the legalities of sending employee information across international lines, HIPAA and all that. And even if an international outsource printed and enveloped it, you'd have to have it flown here to ship, and you'd have to solve the e-file aspect. As with everything it's a trade-off of how much risk you want to pay to transfer.So negotiating in the real world, I'd bet $10,000 to do it right. These are guesstimates--not quite guesses, but not quite estimates, but a start for your thoughts. Hopefully a payroll accountant will strike me down.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How do I file my 1099 MISC tax form?

First of all majority of business and tax documents are filed now in the digitally.Filing the 1099-MISC tax form electronically is easy and straightforward. To prepare any supporting documents needed to complete a sample - you need to be aware of all the data it contains. It has two parts that represent the general contact, identification and tax data and payment details.You can take a closer look at the boxes that you will be required to fill out in this form here: http://bit.ly/2Nkf48f

-

How can I file a form 1099-misc and a 1099B together, if the 1099-misc is due by January 31st and 1099B won't arrive until February?

I’m guessing that you are the person who is receiving those forms. If that is the case, why are you concerned about filing them? The people (or companies) who made the payments to you are the ones who have to file them — what you get is a copy of what was filed by them. They are “information returns”, filed with the IRS and provided to you to furnish information.The only time you would have to file one of those is if there was tax withheld is a reported transaction, and you need to furnish the proof of withholding with your 1040. But that’s kind of unusual with those forms.Worst case, if you had withholding shown on both a 1099-MISC and a 1099-B, and you had to attach them both to your return, you would just have to wait to file your return. Not a problem unless you make it a problem.

Create this form in 5 minutes!

How to create an eSignature for the 1099 misc 2017 form

How to create an electronic signature for the 1099 Misc 2017 Form in the online mode

How to generate an electronic signature for your 1099 Misc 2017 Form in Google Chrome

How to create an eSignature for signing the 1099 Misc 2017 Form in Gmail

How to generate an eSignature for the 1099 Misc 2017 Form from your mobile device

How to make an electronic signature for the 1099 Misc 2017 Form on iOS devices

How to make an electronic signature for the 1099 Misc 2017 Form on Android

People also ask

-

What is a Form 1099 MISC and why do I need it?

A Form 1099 MISC is used to report various types of income outside of wages, salaries, and tips. If your business has paid contractors or freelancers, you must file this form to comply with IRS regulations. Using airSlate SignNow simplifies the eSigning process for Form 1099 MISC, ensuring timely and accurate submission.

-

How can airSlate SignNow help me eSign my Form 1099 MISC?

airSlate SignNow provides an intuitive platform for electronically signing your Form 1099 MISC. With our easy-to-use tools, you can quickly upload, send, and track your forms, ensuring that you meet all deadlines without the hassle of paperwork. Our solution helps streamline your document management process.

-

Are there any additional costs associated with eSigning a Form 1099 MISC using airSlate SignNow?

airSlate SignNow offers pricing plans that are competitive and transparent, with no hidden fees. Each plan includes features to help you manage your forms, including the Form 1099 MISC eSigning process. You can choose a pay-as-you-go model or a monthly subscription based on your business needs.

-

Does airSlate SignNow integrate with accounting software for Form 1099 MISC reporting?

Yes, airSlate SignNow seamlessly integrates with various accounting software platforms, making it easier to manage your Form 1099 MISC reporting. These integrations provide a more cohesive workflow, allowing you to generate and send your forms directly from your accounting software. This saves time and reduces the chance of manual errors.

-

What features does airSlate SignNow offer for managing Form 1099 MISC documents?

airSlate SignNow provides robust features for managing Form 1099 MISC documents, including easy document uploads, customizable templates, and secure eSigning. You can track the status of your forms in real time and receive notifications when they are signed. This enhances your document workflow and ensures compliance.

-

Can I send multiple Form 1099 MISC documents at once using airSlate SignNow?

Yes, with airSlate SignNow, you can send multiple Form 1099 MISC documents simultaneously. This bulk sending feature allows you to save time and streamline your workflow, ensuring that all necessary forms signNow your recipients promptly. It's particularly useful for businesses with multiple contractors.

-

How does airSlate SignNow ensure the security of my Form 1099 MISC data?

airSlate SignNow prioritizes the security of your Form 1099 MISC data by employing top-tier encryption and security protocols. Your documents are stored securely, and access is controlled through robust authentication measures. This ensures that sensitive information remains protected throughout the signing process.

Get more for Form 1099 MISC

Find out other Form 1099 MISC

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template